Explore web search results related to this domain and discover relevant information.

Call and put options give traders diverse opportunities to generate income, protect against losses, and speculate on the market across all types of market conditions. With this flexibility comes some complications, so it's important to learn how options work before jumping in.

Buying calls is one way to speculate on stock prices appreciating, and buying puts is a way to speculate on prices falling. Both strategies can also be used to hedge against unwanted price movements. Options strategies range from simple to complex and from relatively low risk to very high (or unlimited) risk. Understanding the three basic options strategies below may help traders regardless of their risk tolerance and temperament to speculate on volatility, generate income, and manage risk.Contracts are priced per share, so traders need to multiply an options contract's quoted price by 100 to determine the price of a single contract. For example, a call priced at $3.50 would cost the option buyer $350, but the premium paid for an option is typically a fraction of the underlying asset's price.Buying a call option is often considered a bullish strategy because the price of the call option typically rises along with the price of the underlying security. Similarly, call prices typically fall when the underlying security falls. Traders or investors who have a directional view might consider buying a call option as a lower-cost alternative to buying a stock outright.Some option traders turn to call options when they already own the stock. Instead of using calls as a lower-cost substitute for stock, they use calls to potentially generate income on shares they already hold.

A covered call is a basic options strategy that involves selling a call option (or “going short,” as the pros call it) for every 100 shares of the underlying stock that you own. It’s a relatively simple options trade to set up, and it generates some income from a stock position.

A covered call is a kind of hedged strategy, in which the trader sells some of the stock’s upside for a period of time in exchange for the option premium. Normally, selling a call option is a risky thing to do, because it exposes the seller to unlimited losses if the stock soars.Here is the value of the various elements of the covered call at expiration: In this example, the trader who set up the covered call breaks even on the whole trade at $18.50 per share. That’s the stock price of $20 minus the $1.50 premium received. At stock prices below that, the trader loses more money on the stock than was gained from the premium of $1.50.At a stock price of exactly $21 at expiration, the trader keeps the full $1.50 premium, and the stock usually will not be called by the call buyer. The trader also earns any stock gains up to $21 — a maximum of $100 from the $20 starting price.So, between the premium and the capital gain, the trader makes $250 at this stock price. If the stock rises above $21, the short call loses $100 for every $1 increase in the stock price, but this loss is fully offset by the stock’s gain. In this situation, the trader loses all potential stock profits above $21 per share.

New to options trading? Understand the key differences between call and put options and how to use them effectively in your investment strategy.

Call and put options. The difference between buying and writing options. The benefits, risks, and tax implications of trading options. Options are contracts that give you the right to take a specific action in the future, if it'll benefit you. Options trading can allow investors to hedge existing investments from potential downturns or speculate on the price movements of stocks, exchange-traded funds (ETFs), and indexes.With covered calls, there's a risk of missing out on gains if the stock or ETF rises above the strike price of the call option you've written. Similarly, when selling puts, your profit is typically limited to the premium received—even if the stock or ETF experiences significant appreciation. Liquidity. If you need to close your position before expiration, you may face liquidity issues, especially with less actively traded options.This favorable tax treatment can reduce your overall tax liability, especially if you’re an active trader. Options trading is a strategy some investors choose to incorporate into their portfolios, but it's important to recognize and understand the additional risks and complexity associated with puts and calls.It may also be obtained from your broker, any exchange on which options are traded, or by contacting OCC at 125 S. Franklin Street, Suite 1200, Chicago, IL 60606 (888-678-4667 or 888-OPTIONS). The booklet contains information on options issued by OCC. It is intended for educational purposes. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. For further assistance, please call The Options Industry Council (OIC) helpline at 888-OPTIONS or visit optionseducation.org for more information.

Investors have multiple approaches to perform futures and options trading in stock markets. The financial tool known as 'call writing' represents an interesting investment strategy. A method to generate income lets investors sell call options. The investment technique helps investors to check ...

Investors have multiple approaches to perform futures and options trading in stock markets. The financial tool known as 'call writing' represents an interesting investment strategy. A method to generate income lets investors sell call options. The investment technique helps investors to check market fluctuations and maintain profitable opportunities.Investors have multiple approaches to perform futures and options trading in stock markets. The financial tool known as ‘call writing’ represents an interesting investment strategy. A method to generate income lets investors sell call options. The investment technique helps investors to check market fluctuations and maintain profitable opportunities.The procedure enables investors to sell call options with predetermined strike prices for premium income. The strike price represents the authorized amount investors agree on for either asset purchase or asset sale when options contracts reach their expiration date.The person who practices call writing receives payment known as the premium from the call option buyer. A rising stock price enables the option buyers to exercise their purchase rights at the agreed strike price but this scenario results in financial losses for call writers.

An option is a derivative contract that gives the holder the right, but not the obligation, to buy or sell an asset by a certain date at a specified price.

However, if the price of the underlying asset does exceed the strike price, then the call buyer makes a profit. The amount of profit is the difference between the market price and the option’s strike price, multiplied by the incremental value of the underlying asset, minus the price paid for the option. For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25.An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a certain date (expiration date) at a specified price (strike price). There are two types of options: calls and puts. American-style options can be exercised at any time prior to their expiration.The buyer of a call option pays the option premium in full at the time of entering the contract. Afterward, the buyer enjoys a potential profit should the market move in his favor. There is no possibility of the option generating any further loss beyond the purchase price.The call option seller’s downside is potentially unlimited. As the spot price of the underlying asset exceeds the strike price, the writer of the option incurs a loss accordingly (equal to the option buyer‘s profit). However, if the market price of the underlying asset does not go higher than the option strike price, then the option expires worthless.

Suppose ABC shares are trading at $100 today—the owner of the ABC 110 call option hopes shares rise above $110—any appreciation above that represents the potential payout. If you exercise the call when shares trade at $120, then you buy 100 ABC shares for $110 and voilà: your return is ...

Suppose ABC shares are trading at $100 today—the owner of the ABC 110 call option hopes shares rise above $110—any appreciation above that represents the potential payout. If you exercise the call when shares trade at $120, then you buy 100 ABC shares for $110 and voilà: your return is $10 per share for a total gain of $1,000."Exercising a long call" means the call option owner is demanding to buy the stock from the call seller. Upon exercise of a call, shares are deposited into your account and cash to pay for the shares and commission is withdrawn (just like a normal stock purchase). It's important to note that exercising is not the only way to turn an options trade profitable.Using options can help investors limit risk, increase income, and plan ahead. Get more insight on when to use a long call or short call and what it means to exercise or assign a call option.A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration date. The buyer of a call has the right, not the obligation, to exercise the call and purchase the stocks.

In the US, options exchanges such as the Chicago Board Options Exchange and the Options Clearing Corporation are responsible for call options trading. Options traders can use standardized call options trading on different assets such as stocks, indices, and exchange-traded funds (ETFs).

Scenario 1: The stock price goes up: If the stock price rises to, let’s say, $120 per share, you can exercise your call option. That means you can buy company X’s shares at the strike price of $110 strike price even though they’re worth $120 in the market. Your profit from this options trade is $120 – $110 – $5 (premium) = $5 per share.As a member, you can explore the most popular options contracts from our Options Hub, design single and multi-leg trades based on your market outlook, and continue your options trading education with comprehensive video guides. Join Public and take your options trading to the next level. · Note: The Options Clearing Corporations offers a helpful document that discusses the characteristics and risks of options, which can be found on their website. Owning the stock means you purchased the shares of a company. Buying a call option means you can purchase a particular stock at a pre-specified price without the obligation to do so.Learn what a call options are, how they work, and the difference between long & short call options. Find how to buy, sell, and calculate profits, and more.Market swings are unavoidable and unpredictable. Even with a bullish market sentiment, it is crucial to manage risk. To that extent, there are financial avenues that help in mitigating risks. One such avenue is call options.

Some unusual call activity (~14:1 calls over puts) is being seen in aircraft maker Embraer S.A. (ERJ - $1.14 to $59.83) as option traders primarily target the September 17th 65.00 call. Volume on this contract is 2,095 versus open interest of 1,469, so we know that we have some fresh positioning ...

Some unusual call activity (~14:1 calls over puts) is being seen in aircraft maker Embraer S.A. (ERJ - $1.14 to $59.83) as option traders primarily target the September 17th 65.00 call. Volume on this contract is 2,095 versus open interest of 1,469, so we know that we have some fresh positioning here.Some unusual put activity (~24:1 puts over calls) is being seen in Canadian National Railway Co. (CNI - $0.45 to $95.45) as option traders primarily target the October 17th 95.00 put. Volume on this contract is 3,503 versus open interest of 246, so we know that the volume primarily represents fresh positioning.Investors should consider carefully information contained in the prospectus, or if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing. Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab.(TRML + $1.61 to $28.35): Option volume is running at ~94x the daily average on this clinical biotechnology company which is primarily being driven by activity on the September 19th 30.00 call. Volume on this contract is 2,658 (vs. open interest of 200), which mostly consisted of a 999 block that was bought at the ask price of $1.95 and (at a different time) a 994 contract block that was bought for $3.10 when the bid/ask spread was $2.15 x $3.50. We know that both these blocks are new positions based on the open interest figure, and we can assume the intent is bullish on both given where there the trades took place within their respective bid/ask spreads.

Understanding covered calls could help traders potentially earn income from stocks they own, but the strategy has risks. Learn the specifics.

Understanding how this options strategy works could help traders potentially earn income from stocks they own, but it's not without risks. Take the time to learn what's involved. ... Choosing and executing a covered call strategy can be like driving a car. There are several moving parts, but once you've learned the specifics—and become aware of the potential pitfalls—you can steer toward your objective.A covered call gives an option buyer the right to purchase stock shares an option seller already owns (hence, "covered") at a specified strike price and at any time on or before the specified expiration date. Selling covered calls is a popular tactic among traders looking to earn income on stocks they already own.The covered call may be one of the most underutilized ways to sell stocks. Traders who already plan to sell at a target price might consider selling a covered call to collect additional income in the process.While they could sell the shares at $23 right now, they could also sell a covered call at the $25 strike price and collect the call premium while waiting for the stock to (hopefully) increase. When the trader sells the call, they'll receive the premium, which is immediately deposited into their account (minus transaction costs).

Instead of speculating with 0DTE options or high-leverage lottery tickets, strategist Rick Orford explains why deep in-the-money calls offer traders a different kind of edge.

Barchart Trade Picks · Today's Top Stock Pick · All Top Stock Picks · Performance Leaders · Percent Change · Price Change · Range Change · Gap Up & Gap Down · 3, 4, 5 Day Gainers · Before & After Markets · Pre-Market Trading · Post-Market Trading ·Trade Futures With · Futures Trading Guide · Trading Guide · Historical Performance · Commitment of Traders · Commitment of Traders · Legacy Report · Disaggregated Report · Financial TFF Report · Resources · Contract Specifications · Futures Expirations ·

What will a stock be worth at a future date? Buying a call option bets on “more.” Selling a call bets on “less.” Here are 3 examples of call options trading.

This article provides an overview of why investors buy and sell call options on a stock, and how doing so compares to owning the stock directly. ... The basic question in an options trade is: What will a stock be worth at some future date?If you think the market price of the underlying stock will rise, you can consider buying a call option compared to buying the stock outright. If you think the market price of the underlying stock will stay flat, trade sideways, or go down, you can consider selling or “writing” a call option.Buying calls, or having a long call position, feels a lot like wagering. It allows traders to pay a relatively small amount of money upfront to enjoy, for a limited time, the upside on a larger number of shares than they’d be able to buy with the same cash.The buyer has two choices: First, the buyer could call the stock from the call seller, exercising the option and paying the strike price. The buyer takes ownership of the stock and can continue to hold it or sell it in the market and realize the gain. Second, the buyer could sell the option before expiration and take profits. When the stock trades at the strike price, the call option is “at the money.”

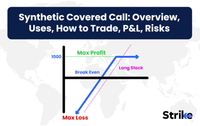

A synthetic covered call is an options trading strategy designed to replicate the payoff of a traditional covered call without requiring ownership of 100 shares.

A synthetic covered call is an options trading strategy designed to replicate the payoff of a traditional covered call without requiring ownership of 100 shares. A synthetic covered call uses a deep in-the-money call to mimic share ownership and an out-of-the-money call to generate income. This makes it highly capital-efficient for traders who want exposure to premium income without tying up large capital.This structure is often referred to as the “Poor Man’s Covered Call” or a more flexible form of covered calls, but technically it is a pure synthetic equivalent. Unlike holding shares, the trader holds option contracts that simulate share behavior and option-writing income.Net Exposure: Similar to long stock plus short call, but without needing to buy 100 shares. Margin Requirements: Typically lower than buying stock, making it attractive to retail traders.Capital Efficiency: Buying stock requires significant cash, while a deep ITM call costs much less. Lower Entry Barrier: Retail traders can access strategies on high-priced stocks without needing thousands of dollars.

Opendoor Technologies (OPEN) has been the target of call traders as it rallies to three-year highs

Understanding covered calls could help traders potentially earn income from stocks they own, but the strategy has risks. Learn the specifics.

Understanding how this options strategy works could help traders potentially earn income from stocks they own, but it's not without risks. Take the time to learn what's involved. ... Choosing and executing a covered call strategy can be like driving a car. There are several moving parts, but once you've learned the specifics—and become aware of the potential pitfalls—you can steer toward your objective.A covered call gives an option buyer the right to purchase stock shares an option seller already owns (hence, "covered") at a specified strike price and at any time on or before the specified expiration date. Selling covered calls is a popular tactic among traders looking to earn income on stocks they already own.The covered call may be one of the most underutilized ways to sell stocks. Traders who already plan to sell at a target price might consider selling a covered call to collect additional income in the process.While they could sell the shares at $23 right now, they could also sell a covered call at the $25 strike price and collect the call premium while waiting for the stock to (hopefully) increase. When the trader sells the call, they'll receive the premium, which is immediately deposited into their account (minus transaction costs).

Discover everything about Call Options: how they work, why they’re powerful, and how to spot the best ones today. Maximize your trading with real-time insights.

TradeVision Blog | Get Wall Street Quality Data Now ... If you’re serious about maximizing your trading profits, understanding Call Options is essential. Whether you’re new to the world of options trading or an experienced investor, call options provide unique opportunities for profit, even without owning the underlying stocks.The key to successful call options trading is predicting the direction of the stock price movement and timing it correctly. Traders gravitate toward call options for several reasons:Using platforms like TradeVision can help you spot trends and signals that many retail traders overlook. With AI-powered scanning, real-time alerts, and technical filters, you can quickly identify high-potential call options.Explore TradeVision’s market intelligence tools for tailored insights. For those interested in actionable advice, here are a few call options worth considering, based on current market momentum:

The price is called the strike price. The strike price and the exercise date are set by the contract seller and chosen by the buyer. There are usually many contracts, expiration dates, and strike prices that traders can choose from.

A long call option is the standard call option in which the buyer has the right, but not the obligation, to buy a stock at a strike price in the future. The advantage of a long call is that it allows the buyer to plan ahead to purchase a stock at a cheaper price. Many traders will place long calls on dividend-paying stocks because these shares usually rise as the ex-dividend date approaches.Call option payoff refers to the profit or loss an option buyer or seller makes from a trade. Remember that there are three key variables to consider when evaluating call options: strike price, expiration date, and premium. These variables calculate payoffs generated from call options.There are several factors to consider when it comes to selling call options. Be sure you fully understand an option contract's value and profitability when evaluating a trade, or else you risk the stock rallying too high.Put Option: What It Is, How It Works, and How To Trade · Understanding Option Strike Prices: Definition, Function, and Impact · Sell to Open: How It Works in Options Trading With Examples · Master the Short Straddle Options Strategy: Techniques and Examples · Understanding Option-Adjusted Spread (OAS): Definition, Example, and Impact · At the Money (ATM) in Options Trading: Definition and Key Insights · Max Pain in Options: Calculation Method and Real-Life Examples · Covered Calls Strategy: Generate Income & Manage Risk

:max_bytes(150000):strip_icc()/call-option-4199998-ddd54a71fc9a479f9dda9e5b9943d9c4.jpg)

Costco reports August 2025 sales up 8.7% to $21.56B, with e-commerce rising 18.4%.

This call will include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that may cause actual events, results and/or performance to differ materially from those indicated by such statements.The risks and uncertainties include, but are not limited to, those outlined in today's call and sales release as well as other risks identified from time to time in the company's public statements and reports filed with the SEC.Costco Wholesale Corporation (NASDAQ:COST) Period Ending/ Trading Statement Call September 3, 2025 8:00 PM EDT

Call and put options give traders diverse opportunities to generate income, protect against losses, and speculate on the market across all types of market conditions. With this flexibility comes some complications, so it's important to learn how options work before jumping in.

Buying calls is one way to speculate on stock prices appreciating, and buying puts is a way to speculate on prices falling. Both strategies can also be used to hedge against unwanted price movements. Options strategies range from simple to complex and from relatively low risk to very high (or unlimited) risk. Understanding the three basic options strategies below may help traders regardless of their risk tolerance and temperament to speculate on volatility, generate income, and manage risk.Contracts are priced per share, so traders need to multiply an options contract's quoted price by 100 to determine the price of a single contract. For example, a call priced at $3.50 would cost the option buyer $350, but the premium paid for an option is typically a fraction of the underlying asset's price.Buying a call option is often considered a bullish strategy because the price of the call option typically rises along with the price of the underlying security. Similarly, call prices typically fall when the underlying security falls. Traders or investors who have a directional view might consider buying a call option as a lower-cost alternative to buying a stock outright.Some option traders turn to call options when they already own the stock. Instead of using calls as a lower-cost substitute for stock, they use calls to potentially generate income on shares they already hold.

PR agency bosses open up on what trading in August was like, as part of the PRWeek Top 150 Monthly Trading Tracker.

PR agency bosses open up on what trading in August was like, as part of the PRWeek Top 150 Monthly Trading Tracker. | PR Week UK

In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial ...

This effectively gives the buyer a long position in the given asset. The seller (or "writer") is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides. This effectively gives the seller a short position in the given asset. The buyer pays a fee (called a premium) for this right.The call contract price generally will be higher when the contract has more time to expire (except in cases when a significant dividend is present) and when the underlying financial instrument shows more volatility or other unpredictability. Determining this value is one of the central functions of financial mathematics.In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial ...The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

:max_bytes(150000):strip_icc()/call-option-4199998-ddd54a71fc9a479f9dda9e5b9943d9c4.jpg)